The Hashprice Covered Call Strategy

You can execute a 'covered call' with your bitcoin miners by mining with your machines while waiting for it to sell on the open market. Read on to learn how, when executed properly, this strategy can hedge BTC-denominated price risk in the ASIC market.

Over the past year, we’ve seen a big push for home bitcoin mining, and the audience for bitcoin mining-related content and analysis has grown tremendously. When you look at publicly traded companies it is no secret that mining has been extremely profitable during the bull market and even now, miners are enjoying very comfortable margins. For those we call “pleb miners” however, the story might be different.

I suspect that mining will always be somewhat profitable in dollar terms, or that some miners will always mine for other reasons than just profitability (e.g., as a way to acquire non-kyc bitcoin or just to help secure the network). But bitcoiners being bitcoiners, we have started to look at investments in BTC terms. Otherwise, what is the point of a Bitcoin standard?

Historically, mining has been very profitable in BTC terms and the surprising life expectancy of older ASICs such as the S9 is a testament to this. But as network hashrate continues to grow, and the price of ASICs increases, profitability in BTC terms will reach new lows.

Hashprice always trades in backwardation–meaning the future value of hashrate is always trending lower with time. As such, it’s important for bitcoin miners to hedge downside risk at times when mining profitability is weak.

In this article, I will present the Hashprice Covered Call strategy, which is just a fancy name for one way to increase BTC returns as an individual miner.

The Hashprice Covered Call Strategy: How to Leverage Optionality With You Bitcoin Mining ASICs

If you’re not already familiar with the concept of a Covered Call, I suggest you take some time to look it up because it’s integral to this strategy.

Putting the price of BTC aside, is it not crazy to imagine that the network difficulty will grow between 50% to 100% per year for the next 2 years before the next halving. At the time of writing, according to the Hashrate Index’s ASIC Price Index, Bitmain’s S19s series miners are selling on average for $8500 or 0.200 BTC (at current prices).

Assuming a 50% increase in difficulty annually, an S19 would earn you between 0.181 and 0.226 BTC (with avg tx fees at 5%) over the next two years (this is revenue and doesn’t include electricity costs). For the sake of simplicity, let’s say this is about $250 per month (a little over $0.10/kWh).

Keeping 100% of your BTC rewards and paying your OPEX in USD is up to you. However, you can make a quick comparison between holding your mining reward and buying bitcoin at market price. In this case, the calculation stays the same. Let’s assume BTC is at $38,000, your earning would be $250/months during 24 months. Hence 0.157 BTC earned. Obviously, you could argue the steady growth of BTC price would lower this figure, the point here is to emphasize that a higher OPEX will always decrease your profitability by a non-trivial amount.

As you can see, even under a conservative assumption for hashrate growth and given the current elevated price of ASICs, mining at home is somewhat of a risky bet when you have the much easier alternative of just buying spot BTC at current prices. (Again, this is a viable argument if you are only interested in profitability, otherwise, alternative reasons for mining at home are self-evident)

Now, imagine that you could mitigate this “risk” by using your machine as an option on future bitcoin returns. Thinking about ASICs as a commodity opens up the possibility of trading the future rewards of said commodity (the mined bitcoin).

Because network data and mining metrics are now easily accessible, miners have the ability to make educated decisions about current and future market conditions.

For example, the transparency that Hashrate Index brings to the community allows for the emergence of a new category of individual miners: hashprice traders. Instead of passively waiting for your mining rewards to catch up with your initial BTC investment, you can try to outperform your predicted return on investment by trading hashprice premiums and discounts depending on market conditions.

Why does an ASIC covered call make sense?

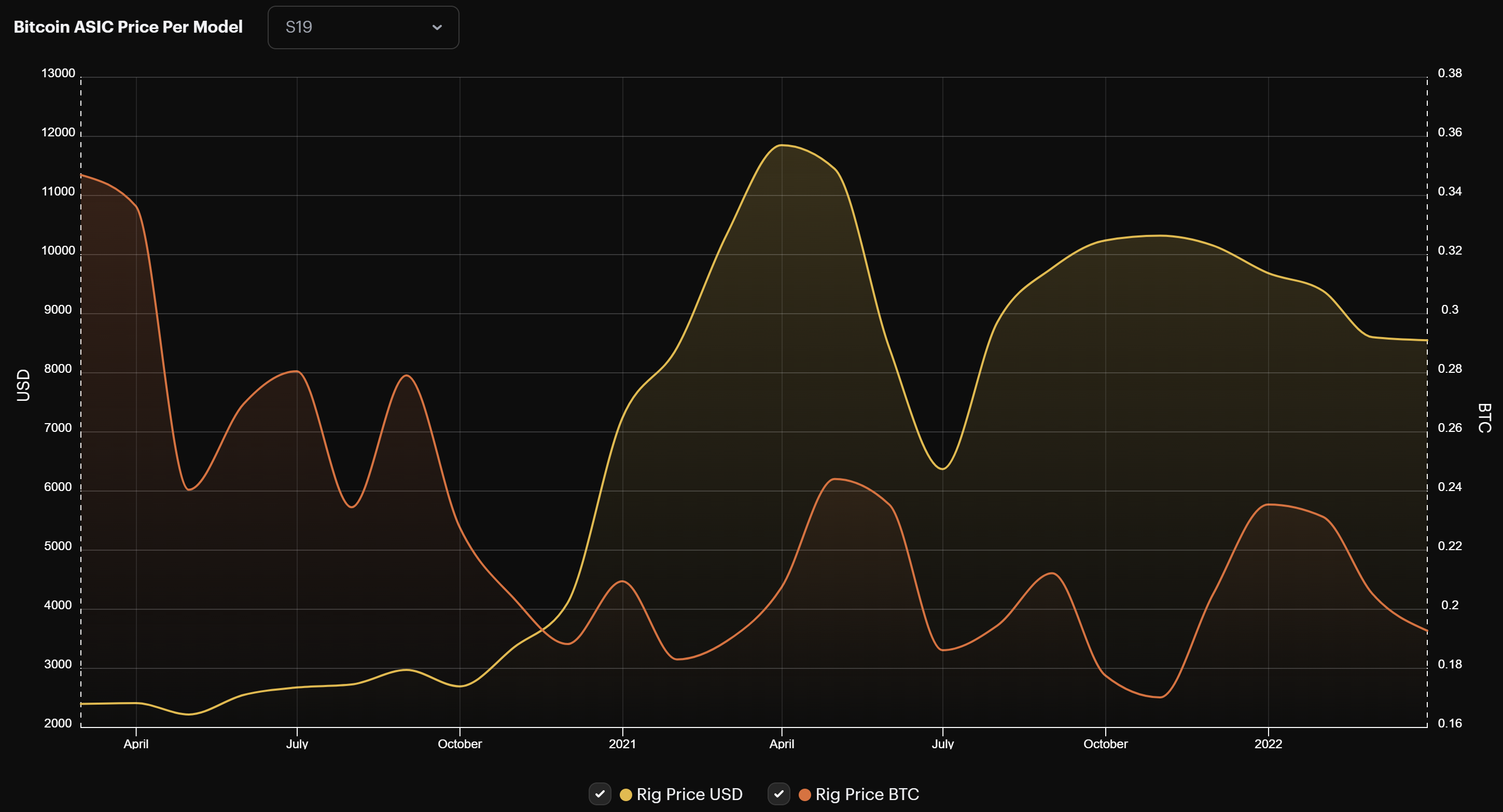

Using accessible data, anyone can figure out when ASICs are overvalued or undervalued in BTC terms. Yet, because Bitcoin lives through such intense Bull and Bear markets, these opportunities are not fully exploited. ASIC markets are inefficient: for bitcoin miners, it’s key to identify these inefficiencies when entering or exiting the ASIC market.

Let’s assume the exact same conditions as the previous example, but this time focusing on the volatility of ASIC prices.

When ASICs were at a steep discount following the China ban, buying an S19 at $6300 (with a BTC price of $36k) equaled an initial investment of 0.175 BTC.

With our covered call strategy, you can list this rig to sell while mining with it. You can use this optionality as a hedge and as a way to capture additional upside when selling a rig for a gain.

Bitcoin Mining Covered Call Strategy: Buy, Mine, Sell

So, after you buy the S19, you immediately decide to list your machine for sale at a predetermined price that would imply a significant overvaluation for the machine compared to what it can earn in BTC over its useful life. You would need to constantly update this listing price to reflect current market conditions, and in particular the BTC price in relation to the price of your machine.

Let’s assume that for the amount of risk that you are taking, you would be happy to forego some of the potential upside of future mining returns for a quick 30-50% ROI.

So, you list your machine for sale at $9450 and you start to actively monitor the market.

The beautiful thing with the ASIC market is that there are always situations where it is “lagging” compared to the price of Bitcoin. Acting on this “lag” is at the core of the strategy.

By setting your profitability threshold at 30-50% with a BTC price of $36k, you are effectively aiming for a BTC denominated return of 0.227-0.262 (0,052-0.087 profit). So, when the price of BTC reaches $55K by mid-October, you re-adjust your ask to reflect the BTC price increase (you would only earn 0.190 BTC brut of mining returns at these prices). Selling during a rapid price increase is generally not a viable strategy.

However, selling during a rapid price decrease can be very profitable as the price decrease of the ASIC will tend to lag behind the price. When BTC went from $55k mid-December to $42k by mid-January, an almost 25% correction, S19 prices went from ~$10k to ~$9k, a 10% correction.

Selling your machine at $9k with BTC at $42k = 0.214 BTC, a 24% return. However, because your machine was running for an additional 3 months compared to October, you need to add those additional mining returns. This is an additional (0.075-0.035) 0.04 BTC* for 6 months of mining totaling 0.254 BTC or a 46% BTC denominated return. (You could also add in this calculation the additional BTC that you can now stack directly instead of using it for OPEX costs which, over the life of an ASIC, will make an even stronger case for this strategy vs passively self-mining. Again, I will do this for the sake of conservatism here, but $250 per month for 3 years, even with a BTC price of $100k equals an additional ~ 0.1 BTC!)

This is the covered call part, even if you don’t sell at your anticipated price, you are still earning mining rewards while you wait for the machine to sell. If you are already mining for profit, what do you have to lose?*

*The answer to this question is pretty simple, you are risking to lose on the potential superior BTC returns if the market conditions unexpectedly make mining more profitable in BTC terms (ie. a mining ban in the US after the halving). Just like traditional covered calls, you are essentially betting on optionality.

In addition to this, using this strategy also makes sense because the present value of money (BTC in our case) is always superior to the future value of money. Would you rather have 1 BTC now or in 5 years?

Successfully executing this strategy also allows you to do it again because you now have more available capital waiting to be deployed.

(Theoretically, you could execute this strategy as long as your trade window is not superior to the useful life of the ASIC. If it’s 5 years, this means that you have X tries over the next 5 years to outperform the passive return that you would have earned anyway. In practice, ASICs are not very liquid and take time to be shipped/delivered, limiting your uptime and as a result the lowest % return that you should make on a trade).

Now, of course, opportunities like this are not common but over the useful life of an ASIC, I do believe that their frequency justifies the validity of this strategy. These arbitrage opportunities will always be there.

ASIC covered calls and future bitcoin miner trading strategies

While this is just a simple trading strategy for individual miners, it is no secret that the financialization of the industry will inevitably lead to the creation of structured products that will open up the realm of possibilities for mining-related investments. Among other things, the commoditization of hashrate is an emerging trend that will be profoundly transformative.

It is safe to say that the early iterations of these products, such as the hashrate futures, the overpriced “Hashrate Tokens” sold by untrustworthy exchanges, and to a certain extent cloud mining contracts, have all relatively failed due to their highly centralized and inefficient nature. However, as the industry matures and the market for these products slowly starts to make sense, we can expect higher-complexity strategies to emerge creating even more Bitcoin-oriented opportunities.

Many companies have identified this need for Bitcoin-native investments and have been working on interesting concepts. Atomic.Finance, for example, has started to experiment with the use of DLCs (Discrete Logs Contracts) and traditional options to generate BTC returns in a non-custodial way. It is not impossible to imagine that they will offer mining-related products in the future.

Others like Alkimya, are focusing on “Hashpower as an asset class”, giving the ability to miners to commoditize their hashrate and sell it on a decentralized marketplace to hedge their operational costs. On the other side of the trade, buyers of these contracts can access the mining market without the hassle of dealing with physical machines.

This article is a guest post by Guillaume Girard and reflects his views and opinions only. This article is not financial advice; you should consult with a trusted financial advisor before making investments into Bitcoin mining.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.